Unlocking the Potential of your New Product Development Portfolio: Executive Management of Uncontrollable and Controllable Risk

Managing new product development is tougher than ever: Explosive technological progress, collapsing product lifecycle times, a volatile mix of international regulations, and accelerating cross-industry disruptions present executives of diverse portfolios an ever-growing challenge on how best to allocate their company’s resources to new product development.

Moreover, and possibly the biggest emerging challenge to leaders is gauging the sustainability and speed-of-change of business models themselves to identify winning solutions and high-potential partners

VUCA (volatility, uncertainty, complexity, ambiguity) is a business term top of mind of nearly all business executives today. We recently conducted a survey of 20 Japanese executives representing a range of industries from healthcare to performance materials to IT systems as to what leadership capabilities they most valued for long-term success. The results were not surprising. From a list of 12 strategic priorities the top four were:

1. Agility and Managing under Uncertainty

2. Innovation and New Business Development

3. Organization and Diversity Management

4. Market and Business Environment Sensing

From this, we might summarize the top strategic priorities for leadership as “Fostering an agile organization in pursuit of sustainable new business”.

Interestingly, among these executives, the next highest priority was:

5. Strategy and Portfolio Management.

Although considered more of a critical, baseline leadership capability rather than a game-changer in today’s business ecosystem, this article will outline how Strategy and Portfolio Management can be improved, especially regarding risk management, to support the higher ranked priorities. We first characterize Uncontrollable vs Controllable risk, and then drill down into the elements of Controllable risk to provide direction on how companies can reduce their exposure.

Addressing Uncontrollable Risk

Every strategy and every new product development program come with an ever-increasing inherent level of risk, with the highest risk now often being that of taking little or no proactive action at all. For every development program these “uncontrollable” risks can and should be estimated and captured for program evaluation, support, and overall portfolio optimization.

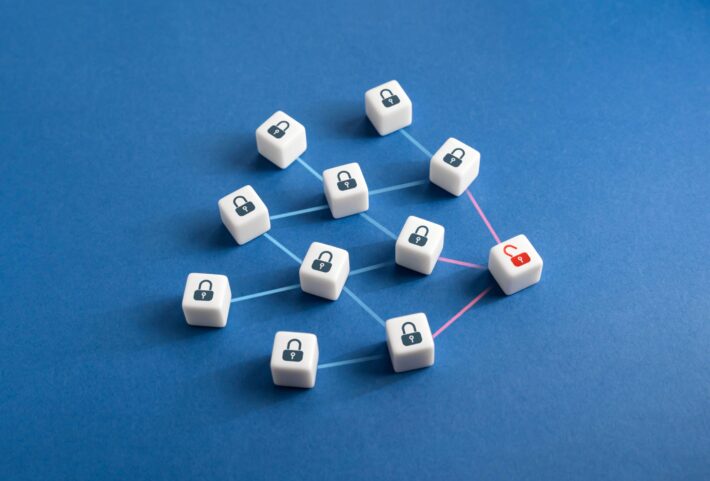

The level of risk can be estimated in several ways, but we have found a Matrix Approach is often the most practical. This involves mapping the level of commercial risk against the level of technical risk faced by the company for each development effort to determine an overall program risk factor. In the simplified example below, Figure 1, we show such a risk matrix estimation, or in this case the inverse, the probability of success (POS).

A complete analysis of the risk would consider a broad range of commercial and technology factors such as:

Commercial Risk: Market (Unmet) Need, Customer base, Customer buying behavior, Distribution and sales network, Competitiveness, Regulatory/Political/Social Environment, etc.

Technology Risk: Technical Gap, Program Complexity, Development Timeline/Cost, Platform alignment, Tech Skill Base, Production/Quality Capability, Partner/Alliance Support, etc.

Note that these are just examples and each company would need to determine the factors, as well as the index values, most appropriate for their business.

Armed with these Risk or POS estimates the company can better adjust financial forecasts and make portfolio prioritization decisions accordingly.

Taking control of controllable risk

In managing a portfolio of new product development programs, companies often expose themselves to risks which are largely under their control to avoid. Some of these can be addressed rather quickly, while others require a more fundamental change in mindsets and business practices and are challenging to implement. Broken down into three (3) business elements outlined below, we share controllable risks based on our experience with numerous product development and portfolio management programs and a wholistic view on how to overcome roadblocks.

1. Strategic Governance Risk (Strategic bucketing, Decision Making)

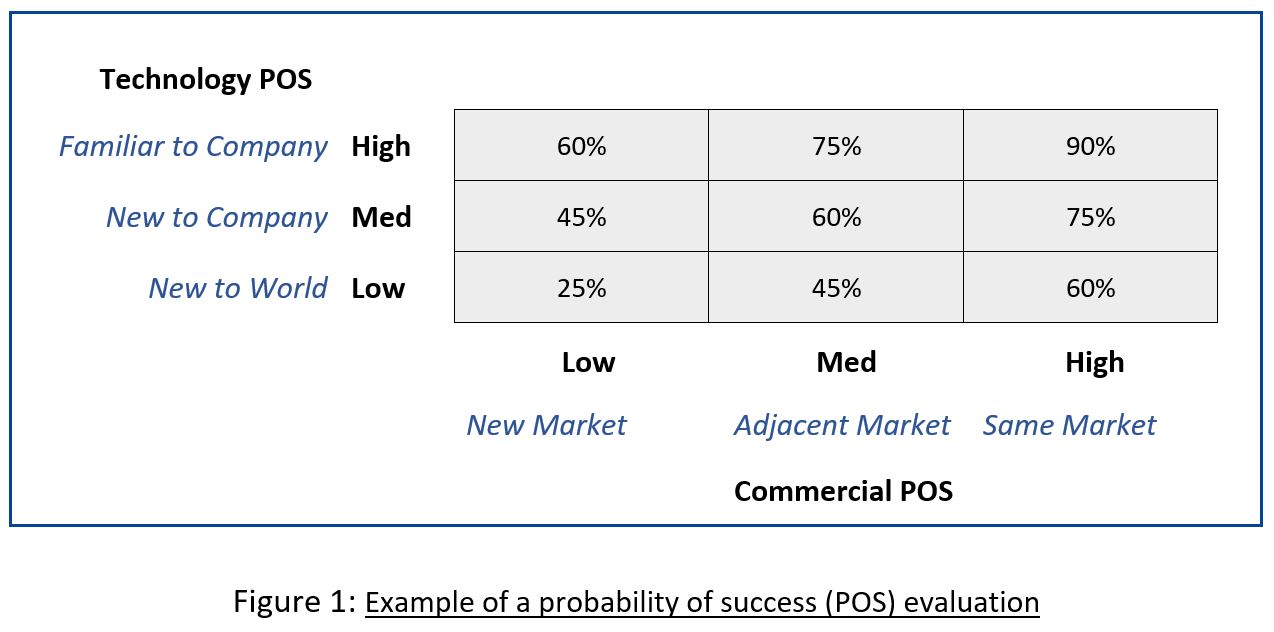

Strategic bucketing allows companies to accurately implement strategy through portfolio management by delineating target program attributes (buckets) and independently address their relative priorities for resourcing, management, and performance. Without such a bucking structure, companies run the risk of managing their portfolio in a one-size-fits-all approach on the one hand, or an ad hoc, each-program-on-its-own method on the other. Neither is a good way to manage a diverse pipeline of programs.

There are innumerous ways that buckets can be structured such as, product/platform types, market/geography, development phase, etc., but for the focus of this discussion, we’d like to provide an example illustrated throughout C. Christensen’s writings and especially in his book, “The Innovator’s Solution”, see Figure 2.

Reference source: C. Christensen “The Innovators Solution”

Segmenting the portfolio in this way gives the company both the clarity of purpose, and the freedom needed to optimize the way programs are prioritized, funded, staffed, and managed. Further, by implementing an emergent strategy within the same portfolio, as opposed to an externalized venture or skunkworks-type approach, embeds the value of both strategies in the culture, and builds operational agility.

Decision Making. Quality product development decisions involve having the cross-functional executive team regularly convene to evaluate individual programs at well-managed Gate Reviews for clear Go/No Go decisions, providing guidance, and to reallocate resources across the portfolio as needed.

A key risk here is not stopping low-potential programs that can languish in the pipeline sucking up valuable resources and management mindshare. After the identification and launch of high-potential programs, the most valuable action management can take is to stop those that don’t pan out. Especially for emergent strategy programs the company must have a cultural mindset to “fail fast and start again”. It is critical to success of such programs to take stock in valuable hands-on experience, the institutional lessons learned, then adjust and move on.

2. Resource Capability Risk (Expertise Development, Resource Deployment)

Expertise Development. The organization must have a clear vision of the functional expertise needed to support the strategy and programs success with strong talent development practices in place. As you can see in Figure 2 above, the competencies needed for emergent strategy programs are quite different from sustaining innovation. Failing to recognize and react to the dynamic changes in resource requirements will put program success at risk.

Resource Deployment. Even more common is the risk that high-quality resources are spread too thin across the portfolio. It can happen with any function, but for new product development, we often see deficiencies with inbound strategic marketing expertise that understands the market beyond and ahead of the customer. Companies need to be more careful to limit their portfolio to the number of programs they can staff for success.

3. Program and Portfolio Management Risk (Business Planning, Forecasting, Pipeline Visibility)

Business Planning. Even well-staffed programs often suffer from silo-style contributions from key functions. Without cross-functional core teams that enable true ownership and collaboration from the members programs can lack the integrated business planning that bring out organizational synergy.

Forecasting. Program and Cross-program financial models should provide a logically consistent evaluation of the portfolio potential value against identified risks. Risks here include inconsistent approaches which eliminate the ability to accurately evaluate and prioritize programs against each other. Another risk is cultural, as in the case of Japan, where stopping a project represents “failure”, and programs tend to continuously inflate the potential and then carry on in a zombie state for years.

Pipeline Visibility. Quality data should be consolidated in a timely manner to facilitate resource and portfolio decision making annually and at program gate reviews. Not having this transparency stifles a company’s agility to stop or start new projects in near-real time, leaving the portfolio stagnant outside of the annual budgeting cycle.

Conclusion

Corporate executives face more than enough inherent or uncontrollable risk in managing their pipelines of opportunity. Unfortunately, many expose themselves to multiple times more risk by not addressing the controllable risks within their new product development operations. In taking action to reduce these hazards, some aspects can be addressed independently in the short-term, but a most of these challenges are highly inter-related and organizations should consider taking the time to implementing improvements holistically.

About the Author

Arthur “Wood” Bastian is an American that has based his family and professional life in Japan for nearly 30 years. With a degree in physics and an MBA, experience in both industry and consulting, his passion is to help leadership teams better connect to the world by bridging gaps in technology and business, building collaborative cross-cultural teams, and problem solving in challenging international environments. He works with executives and upcoming leaders to plan and execute programs to help organizations and individuals achieve their goals.