This article was originally published on the website of our colleagues at Bird & Bird. We thank them for the opportunity to publish it here as well.

In the context of the digital economy, data is often referred to as the new fuel driving the economy. This comparison has its origin in the title of a May 2017 report by The Economist entitled “The world’s most valuable resource is no longer oil, but data”. The saying “data is a new oil” became a kind of cliché.

While this comparison is highly evocative, it doesn’t fully reflect reality. There are a number of differences between how oil and data affect the economy.

Is data the new fuel for the economy?

With oil, one of its central characteristics is the location of its reserves and their finiteness. Those who control the oil fields and the ability to extract the oil have the greatest impact on the economy.

With data, conversely, there is seemingly no risk of running out of resources. On the contrary, exponentially more data is present in each moment. But data only becomes new fuel for the economy when it is able to be used as such.

The Cambridge Analytica affair (leaving aside any ethical or legal questions) has demonstrated the potential scale of influence based on the use of data on our reality in the world in which we live. Merely having data is not enough – its analysis, clearing it of the so-called noise and appropriate aggregation allows for its effective deployment – often with amazing efficiency and effect.

This means that the focus has shifted from the owners (or original collectors) of the data to those who can use it. These are rarely the same people.

Non-personal data

This is especially true for non-personal data produced in industry.

Such data is typically collected in isolated, standalone databases. Every organisation has its own data, and almost every organisation tries to build its future business model on it.

However, the nature of data is such that to use it effectively, more and more of it is needed. Especially if it is to be used within solutions based on artificial intelligence and machine learning. These solutions are so demanding in terms of the amount of data needed that it is no longer sufficient to rely just on the data collected by the one organisation. For many, there is still not enough of this data to gain a meaningful competitive advantage.

Enter an increased focus on growing collaboration and data sharing between organisations.

Sharing data?

For more commercially ‘protectionist’ businesses, it’s not an obvious solution, or at least a comfortable one. Some fear risking trade secrets – whilst others fear losing their competitive advantage.

However, more and more examples are emerging where competitors are overcoming their fears. One such area is the pharmaceutical industry where developing new drugs, which typically requires significant experimentation, is extremely expensive.

Using machine learning mechanisms to analyse the resulting data has reduced costs and research time, but machine learning algorithms don’t work fully effectively when they have a limited supply of new data. The more data available for training, the faster (and more precisely) those algorithms are able to accurately identify molecules that have the potential to become new drugs.

Ten major pharmaceutical companies, including GSK, AstraZeneca and Johnson & Johnson, have entered an agreement with the French company Owkin, with whom they will share their data. (Pharma groups combine to promote drug discovery with AI)

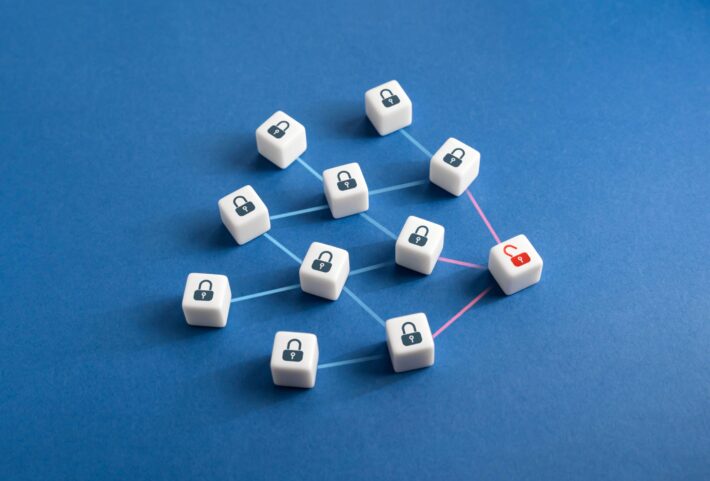

The companies are sharing their research data to improve the search algorithm to make it more accurate and effective. The data is shared through a blockchain-based platform built by Owkin to ensure full traceability of all activities on the platform.

Each partner in this project submits their data to Owkin to be used to train the machine learning algorithms and improve its effectiveness. While the data is not disclosed to competitors, each of them can then use the improved algorithm to pursue their own research further.

Why is this important?

In many fields, progress is slower than desired. This is partly because organisations works in silo from others on similar solutions. Some might argue it is also partly down to concerns about compliance with data protection laws.

However, Owkin’s solution shows how organisations – in this case in the pharmaceutical industry – can accelerate progress by sharing their data in a way that allows them to simultaneously maintain a competitive balance against each other.

To the extent that data is the “raw material” for quality competition and innovation, enhancing data access will promote rather than impede competition. However, to ensure that the resulting competitive advantage over those competitors who don’t share their data does not infringe competition law the following considerations are relevant:

- data sharing may amount to an exclusionary practice where competitors who are denied or granted access on less favourable terms are effectively shut out of the market;

- data sharing arrangements that include competitive sensitive information may amount to anti-competitive information exchange;

- sharing of data that discourages/prevents competitors from differentiating and improving their own data collection is likely anticompetitive; and

- granting data access on non-FRAND terms may result in an exploitative abuse.

Could it be, then, that the future belongs to those who will be the first to shed their fear of losing their data and partner with competitors to co-create better and better algorithms to develop improved products faster? And thus, quickly increase the advantage over traditionalists who prefer to protect their data at all costs?

Only time will tell. In the meantime, here are some recommendations on where to start:

How to approach Data Sharing Partnerships

Starting with a clear idea and vision of what role data will play in your business model and value proposition is fundamental. What output is wanted, or expected, from AI solutions? What value add should they deliver? What are the possibilities and opportunities of a technology like AI now and what are they likely to be in a couple of years and beyond?

With this foundation in place, the partnership that will enable testing and realising these ideas can be designed and set up, in several steps:

1. Intent

Start with defining the capabilities needed, your expectations and goals, as well as ideal partnership scenarios. Once you have identified these, look at possible risks and how to mitigate them, including legal risks and opportunities, and what your options are. Based on this you can develop an agile iterative approach to partnership development and define a high-level engagement process (scouting, screening, testing, contracting, onboarding etc.).

2. Selecting partners

The basis of success is to understand which potential partners may benefit from a co-operation; only those partners are likely to show the commitment required. Once those potential partners are identified screening, testing and evaluating them can commence, followed by negotiating and signing an agreement with them (including, importantly exit rules and conditions).

Clearly, the best way to start to create the motivation and trust needed for data sharing is exploring and developing mutual benefits and solutions together so that:

- all parties can clearly see the benefits they have co-developed; and

- new solutions and innovations can emerge that neither party could have developed without the other.

If you can find potential data sharing partners among existing business partners (supplies, clients etc.) this will make many aspects of the above process easier.

3. Pilot partnership

We have seen many times the benefit of planning for a dedicated piloting phase, when partners can test their cooperation, identify obstacles, develop experience of how to eliminate them and of solving issues collaboratively.

It is very helpful, while still being committed, to have relatively easy exit and alternative options available if the collaboration does not work out as envisaged. Rather than being forced into conflict as a result of non-negotiable deadlines, it’s advisable to be inspired by ambitious goals and take an iterative agile approach that includes continuous feedback, improvements, and the development of new ideas.

It’s also important to constantly monitor the cooperation quality, mutual benefits and risks, and up-scale potential.

4. Extend or exit

After the pilot stage, you should decide whether to extend or reduce the partnership based on your learnings and conclusions.

One significant item to bear in mind is that high-performing partnerships pay attention to both to the content and the relationship. In data sharing, where trust is fundamental to success, partnerships cannot be purely technical if they want to succeed and build a real competitive advantage. Many more ideas and opportunities for cooperation between the partners, their networks and ecosystems will materialize through the wider relationship.

Key points to consider when setting up data sharing partnerships:

- Clarify expectations from both/all sides: What are the outcomes we want to achieve together?

- Define needs: What type of partnership do we need? To what extent do we need to collaborate?

- Decide on the right governance structure: How can we work efficiently towards the goals of each partner?

- Contracting: What are the key questions that need to clarified / memorialised, including for the worst case scenario?

- Create incentives: Helping to ensure all parties involved keep their eyes on the common prize.

About the Authors

Jose Rivas is a Partner at Bird & Bird in Belgium. With over 30 years based in Brussels, his practice is a leading authority in competition law, covering articles 101 and 102, state aid, merger control and more.

Tomasz Zalewski is a partner in Bird & Bird’s Commercial group in Warsaw. His expertise spans from government contracts, IT implementation, and licensing agreements, to technology related disputes.

William Wortley is an associate in Bird & Bird’s Intellectual Property Group based in London, focusing on contentious matters. My practice encompasses a number of sectors including Media, Entertainment and Sport, Retail and Consumer, and Technology and Communications.

Friedemann Lutz is a Director at OXYGY. He has supported numerous Management Teams in running demanding change initiatives, translating ambitious strategic goals into reality and reaching and sustaining better business results.